Summary

- FedEx is scheduled to report fiscal first-quarter earnings after the closing bell on Tuesday.

- Earnings have declined in each of the last two quarters, and they are expected to decline again.

- The stock faces numerous layers of resistance if it is going to start a new upward trend.

- Sentiment toward the stock is slowly shifting to a more bearish stance, but it is far from extreme pessimism.

The world's largest overnight delivery company has seen its stock struggle over the past year and investors are hoping the next earnings report can give the stock a boost. Memphis-based FedEx (FDX) is scheduled to report fiscal first-quarter earnings after the closing bell on Tuesday.

Analysts expect the company to report earnings of $3.17 per share on revenue of $17.09 billion. The earnings figure would mark a decline in earnings of 8.4% from the $3.46 EPS reported in the first quarter of 2019. The revenue figure came in at $17.05 billion one year ago, so analysts are looking for a slight increase.

FedEx has seen its earnings decline in each of the last two quarters, declining by 15.2% in the fourth quarter and by 18.5% in the third quarter. Prior to these last few quarters, the company had been doing well with earnings growth, averaging EPS growth of 18% per year over the last three years.

Even as earnings have slipped, revenues have been able to grow. The average annual growth rate over the last three years has been 11% and revenue was up 3% in the fourth quarter.

Looking at some other fundamental indicators for FedEx, I get some differing figures from the Wall Street Journal and Investor's Business Daily. The Journal has the return on equity at 2.9% while IBD has it at 22.2%. The Journal's figure would be considered lower than the average stock while IBD's would be slightly above average.

The Journal has the profit margin at 0.77% as does Yahoo Finance. IBD has the profit margin at 7.6%. Both figures are below average compared to all other stocks.

FedEx has gone on record stating that the trade war is hurting its business and here it is getting ready to report for another quarter and the trade war is still going on. The dispute between the U.S. and China has now stretched to 20 months, and it has taken a toll on many companies and FedEx is definitely one of them.

The Stock Could Be Forming a Double-Bottom Pattern

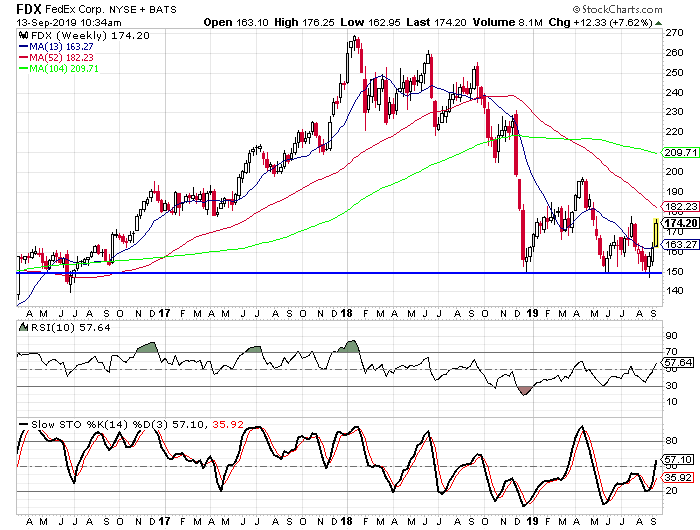

Despite the decline in the stock price since the trade war started, there could be some good news on the chart. The stock recently dropped to the $150 area and seemed to find support there and it is the third time in the last year that the stock dropped to this level. The stock bounced from the $150 area last December and moved back up close to $200 in April. The stock fell again in the second half of April and through May, but once again it found support in the $150 area. The stock bounced back above the $175 level in July before the recent pullback brought it back down to the $150 area.

The stock did drop a little lower on this recent pullback, falling down to a low of $147.24, but it has since bounced back. We could be looking at a double-bottom pattern forming from the low in May and the recent low. For the pattern to be completed, the stock would need to move back above the peak between the two lows. The peak in July was $177.79.

While the potential double-bottom would be a positive sign, FedEx faces several potential layers of resistance if it is going to rally very much. The 52-week moving average has been moving lower for almost a year now and it could certainly act as the first layer of resistance. Looking at the past few years, FedEx hasn't really used the 52-week as support, nor has it acted as resistance.

Even if the stock breaks above the recent high and the 52-week moving average, the peak from April ($197.77) could also act as a resistance point.

Despite the Poor Technical Performance, Sentiment is Still Relatively Bullish

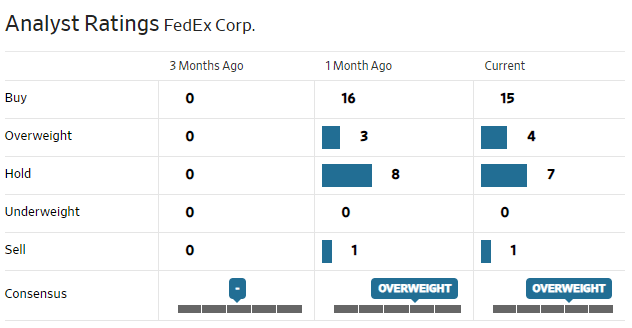

The sentiment toward FedEx has remained rather bullish even as the company has seen earnings decline and as the stock has dropped over 40% from the high in 2018 to the recent low. There are 27 analysts following the stock and 19 have the stock rated as a "buy". There are seven "hold" ratings and one "sell" rating. This puts the buy percentage at 70.4% and that is right in the middle of the average range. I wrote about FedEx ahead of the earnings report back in March as well and at that time there were 24 "buy" ratings and four "hold" ratings, so we have seen the buy percentage drop in the last six months.

The short interest ratio is at 2.4 currently and that is slightly below the average short interest ratio compared to all other stocks. The ratio was at 2.23 in March, so it has inched up a little in the last six months, but it is still skewed to the bullish side.

The put/call ratio is at 1.16 currently with 87,793 puts open and 75,991 calls open. The ratio is slightly higher than average, and it is higher than it was in June or in March when the last two earnings reports have come out. In both of those cases, the ratio was just under 1.0. The fact that the ratio is slightly higher than average and has increased in the last six months indicates there is an increasing amount of pessimism being displayed by option traders.

None of the sentiment indicators are indicating extreme pessimism, but they have all shifted to slightly more pessimistic readings. This could mean that overall expectations are lower heading into the first quarter earnings report and that could be a good thing for the stock. When expectations are lowered, the hurdle becomes easier to clear and the chances of a positive surprise increase.

I am not ready to take a bullish stance on FedEx. The declining earnings and below-average management efficiency measurements are concerns for me. There is also the matter of the chart and all of the various resistance levels the stock will face as it tries to start a new upward trend.

I do find it encouraging that the various sentiment indicators are moving to more skeptical levels, but they have a long way to go to reach extreme levels of pessimism.

The trade war continues to linger over FedEx and will until it is resolved. Even if the trade war is resolved, we could see the global economic slowdown continue and that will certainly hurt a transportation company like FedEx. Personally I'm not convinced that a trade deal is going to end the slowdown, it will help, but I'm not sure it will be enough to stave off the next recession.

There are too many negative factors for FedEx to make me a long-term bull. Sure, we could see a little boost after earnings, but the earnings report would have to be incredibly strong to halt the downward momentum in the stock, and I just don't think that is going to happen in the current economic environment.

Because of the support at the $150 level, I think it is difficult to make a bearish call, but if the stock were to break $150, the next layer of support is down in the $120 range. At this time, I consider myself neutral on FedEx.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment